Trump Signs Tax Reform Bill Into Law

By Mark R. Baran | December 22, 2017

After an impressive display of speed and discipline, both chambers of Congress passed the final reconciled version of the Tax Cuts and Jobs Act (H.R. 1) and it was signed into law by President Trump this week.

Conference negotiators made several last-minute compromises – intended to either accommodate the concerns of certain lawmakers and/or to remain within the $1.5 trillion budget parameters. The signed legislation follows many months of planning by lawmakers and anticipation by the public.

Below are some of H.R. 1’s most significant tax reform measures:

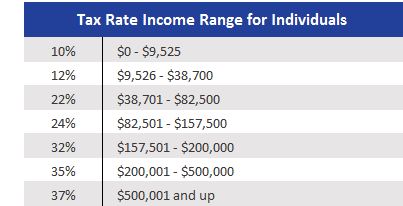

- Corporate and individual tax rates. H.R. 1 replaces the existing rate structure with a new structure. Corporations are subject to a new rate of 21% (up from 20%). Individuals will be subject to a total of seven brackets with a controversial new top individual tax rate of 37% for those who file jointly and have earnings over $600,000. The other six brackets have rates that range from 10% - 35% with all expiring in 2025.

Below are the new rates and brackets for the most common tax filings:

- Pass-throughs.

- 20% deduction and wage limits. Qualified trades or businesses (partnerships, S corporations, and sole proprietorships that are not service trades or businesses) will be allowed a deduction for the lessor of (a) 20% of the qualified business income with respect to such trade or business, or (b) the greater of 50% of the W-2 wages paid with respect to the qualified trade or business OR the sum of 25% percent of the W-2 wages plus 2.5% of the unadjusted basis, immediately after acquisition, of all qualified property. This new deduction also applies to qualified REIT dividends, qualified cooperative dividends, and qualified publicly traded partnership income. These wage/capital restrictions as well as the restrictions relating to services businesses do not apply to taxpayers below certain thresholds.

- Service trades or businesses. Though more guidance will be needed, H.R. 1 attempts to clarify the scope of service trades or businesses. Engineering and architectural businesses are now specifically excluded, and certain financial service activities and performing arts services have been addressed. Theater and film production partnerships are not included in the scope of service trades and businesses and are therefore eligible for the pass-through deduction, subject to the income limitations above.

- Excess business losses. For businesses other than C corporations, excess business losses will be disallowed. Excess business losses are the aggregate deductions over gross income or gain plus a threshold amount of $250,000 (or $500,000 for joint filers). These excess business losses will be treated as a net operating loss (NOL) carryforward.

- Alternative Minimum Tax (AMT). H.R. 1 repeals the corporate AMT, but retains the individual AMT with larger exemptions and phase-out thresholds. The individual AMT exemption amount is increased to $109,400 for joint filers, and $70,300 for all other taxpayers (other than estates and trusts). The phase-out thresholds are increased to $1,000,000 for joint filers, and $500,000 for all other taxpayers (other than estates and trusts).

- Selected individual tax items. Some of the contentious items during negotiations, that are now part of H.R. 1, include several longstanding tax benefits such as the child tax credit, mortgage interest, state and local taxes, and other exclusions and personal exemptions.

- Child tax credit/529 plans. H.R. 1 increases the child tax credit to $2,000 per qualifying child, expands the credit to dependents other than the taxpayer’s children, requires social security numbers, and provides that the maximum amount refundable may not exceed $1,400. 529s can now be used for certain elementary and secondary educational expenses, including private and parochial schools (up to $10,000).

- Mortgage interest deduction. Beginning next year, homeowners may deduct up to $750,000 of acquisition indebtedness ($375,000 for married filing separately). Acquisition indebtedness incurred before December 15, 2017 will be limited to $1,000,000 ($500,000 for married filing separately). Interest on home equity debt will no longer be deductible.

- State and local taxes. Unless paid or accrued as part of a trade or business, individual taxpayers are not permitted to deduct State and local taxes (both property and income taxes). H.R. 1 includes an exception in the form of a dollar amount of $10,000 that taxpayers may deduct for (a) State and local property and (b) State and local income and related taxes (including sales taxes in lieu of income taxes). Taxpayers are not required to use either property or income taxes, as long as the $10,000 itemized dollar limitation is not exceeded. Foreign real property taxes are excluded from this exception. It is important to note that the description of the provision makes it clear that individuals may not claim a deduction in 2017 for prepayments of 2018 income taxes.

- Deductions, exemptions, exclusions. While some familiar tax items have been repealed (i.e. personal exemptions, moving expense deductions, certain fringe benefit exclusions/deductions, alimony deductions), many remained or were enhanced. These include significant increases to the standard deduction, a repeal of the overall limitation on itemized deductions, and retention and temporary improvement of the medical expense deduction.

- Estate tax changes. H.R. 1 doubles the gift and estate tax exemption from $5.6 million to $11.2 million, with continued inflation indexing after Dec. 1, 2019.

- Tax-Exempt Organizations. Among other provisions under H.R. 1, colleges, universities and private foundations would incur an excise tax on certain investment income. In addition, an excise tax of 21% applies to tax-exempt organizations’ excess executive compensation.

- Business tax reforms. In addition to a reduction of the corporate tax rate from 35% to 21%, repeal of the corporate AMT, and the pass-through changes, H.R. 1 makes several other business tax reforms:

- Section 179 expensing. H.R. 1 increases the maximum amount a taxpayer may expense under section 179 to $1,000,000 (from $500,000), and increases the phase-out threshold amount to $2,500,000 (up from $2,000,000).

- Bonus depreciation. H.R. 1 extends and modifies the additional first-year depreciation deduction through 2026 (through 2027 for longer production period property and certain aircraft) and establishes new bonus depreciation percentage rates. The 50% allowance is increased to 100% for property placed in service after September 27, 2017, and before January 1, 2023 (January 1, 2024, for longer production period property and certain aircraft). Original use of the qualified property no longer must commence with the taxpayer, and qualified property eligible for the additional first-year depreciation allowance now includes qualified film, television and live theatrical productions placed in service after September 27, 2017, and before January 1, 2027, for which a deduction otherwise would have been allowable under section 181.

- Accounting methods. H.R. 1 increases the gross receipts test to $25 million, thereby expanding the use of the cash method and exempting certain taxpayers from the requirement to keep inventories.

- Interest deduction. With the exception of certain small businesses with annual gross receipts below $25 million over a three-year period, the deduction for business interest will be limited to the sum of (1) business interest income; (2) 30 percent of the adjusted taxable income of the taxpayer for the taxable year; and (3) the floor plan financing interest of the taxpayer for the taxable year (if applicable). The amount of any business interest not allowed as a deduction for any taxable year may be carried forward indefinitely.

- NOLs. The current rule that allows a business NOL to be carried back two years and forward twenty years has been modified. Except with respect to certain farming business losses, the two-year carryback provisions have been repealed and any unused NOLs may be carried forward indefinitely. The NOL deduction will be limited to 80 percent of taxable income.

- Repeal of §199. H.R. 1 repeals the deduction for income attributable to domestic production activities. Section 199 provides a valuable deduction from taxable income for businesses engaged in specified production activities.

- Carried Interest. H.R. 1 increases the holding period to three years for long-term capital gains with respect to gains attributable to carried interest.

- Self-created property. Taxpayers will no longer be able to elect to treat certain self-created property as capital assets. This includes any patent, invention, model or design (whether or not patented), and a secret formula or process which is held either by the taxpayer who created the property or a taxpayer with a substituted or transferred basis from the taxpayer who created the property.

- International reforms. H.R. 1 addresses several longstanding international tax reform provisions most notably the change from a worldwide system of taxation to a territorial system. Provisions include deductions for dividends received by domestic corporations from foreign corporation and a new base erosion and anti-avoidance tax (BEAT). There is also a one-time two-tier tax rate with an election to defer payment over eight years for previously deferred foreign income (8% rate for illiquid assets, 15.5% rate for liquid assets). For calendar year foreign corporations and US shareholders, this tax is effective for the current tax year of 2017.

- Technical changes. H.R. 1 addresses several technical areas including important partnership tax changes and clarifications. Included in the report are provisions relating to gain or losses on partnership interest transactions, the impact of charitable contributions and foreign taxes on partner loss limitations, and the repeal of partnership technical terminations.

- Effective Dates and Sunset Provisions. The majority of the individual tax provisions, including the new tax brackets and rates, will be effective starting January 1, 2018 and will expire at the end of 2025. Several corporate provisions, including the new rate reduction, are permanent. Several other provisions are effective on various dates. For planning purposes, taxpayers should be aware of effective dates and sunset provisions contained within H.R. 1.

To understand how H.R. 1 affects your specific situation, we strongly encourage you to consult with your Marks Paneth tax advisor. The changes in this bill are diverse, and include many technical and interdependent provisions that will affect the majority of taxpayers.

It is unclear at this time the extent to which guidance from the tax regulatory agencies will need to be implemented in order to effectively comply with any time-sensitive rules now that the bill has been signed into law. We expect to see various technical corrections to H.R. 1, as well as initial procedural and compliance guidance from the IRS soon. Marks Paneth practice groups will be providing additional substantive and procedural analysis.

For more information, please contact your Marks Paneth tax advisor or Mark Baran, Principal in our Tax Services Group at mbaran@markspaneth.com.

About Mark R. Baran

Mark Baran, JD LL.M., is a Principal in the Tax Department at Marks Paneth LLP. He has more than 25 years of tax, transactional and legal experience advising publicly-traded and private companies, regulated financial institutions, investors, high net worth individuals, and government agencies. Mr. Baran’s practice areas include providing tax consulting and transactional services to a broad spectrum of clients and industries including the public sector. He routinely provides tax opinions on the tax implications... READ MORE +