With the tax reform act passed last year, many businesses owners who run their businesses as pass-through entities, such as S Corporations and partnerships, will benefit from the new Sec. 199A business income deduction. This deduction will allow qualifying taxpayers to benefit from a 20% reduction in the federal tax rate on their net ordinary business income from their respective flow-through entity.

Assuming a top bracket of 37%, the Sec. IRC 199A deduction brings the effective rate on flow-through income down to 29.6%. Taxpayers who receive income from their flow-through entity in the form of salaries and guaranteed payments may want to evaluate whether it makes sense to reduce their salaries and bonuses in order to maximize the amount of net taxable income that is eligible for the Sec. 199A deduction.

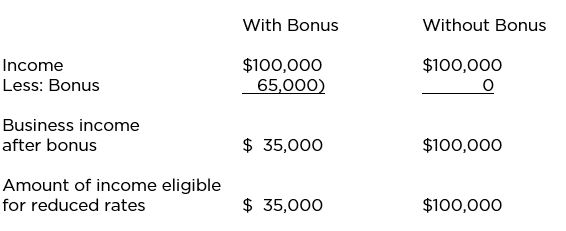

Here is a simplified example of how the deduction works, its impact, and its tax benefit.

The tax savings realized by foregoing the bonus is $4,810 (65,000 x 7.4%).

In the above example, the wages or guaranteed payment are taxed at the top tax rate of 37%, whereas the bonus amount, if not taken as wages or guaranteed payments, will be eligible for the 20% deduction and taxed at 29.6%. Not all business income qualifies for this reduction and there are limitations based on total wages and taxable income.

Of course, most owners don’t want to leave the money behind and therefore the bonus amount could be taken as a non-taxable distribution rather than as a bonus. Please keep in mind that rules regarding distributions and ownership percentages may not obtain the economic results that you, as the owner, are looking for, and therefore not taking a bonus or guaranteed payment is not always in your best financial interest. If you do decide to take a distribution instead of a bonus, remember that estimated tax payments may need to be adjusted accordingly as well.

There may also be additional savings for S-corps in the reduction of the payroll taxes related to foregoing the bonus. This additional payroll tax savings can range from 2.9% to 15.3%.

This is a very complex area, and each taxpayer’s own sets of circumstances will be important to review before implementing any such strategies. Therefore, you must talk to your own tax advisor and plan now before it’s too late.