Qualified Opportunity Zones vs. 1031 Exchanges: A Comparison for Active Real Estate Investors

There has been quite a bit of talk about Qualified Opportunity Zones (QOZs) lately, and with good reason—for sophisticated real estate investors, they present a new investment opportunity that is tied to a government-supported effort to revitalize certain underdeveloped sectors around the country. That’s a fine thing—and an interesting example of a public/private relationship that may produce tangible results. The various intricacies of QOZ investing are now being closely examined, and that’s a fine thing, too, as investors are properly taking a more cautious view of the pros and cons of the tax incentive program – something Abe Schlisselfeld identified so aptly in his recent blog on QOZ and Quality Control.

Tried-and-true like-kind exchanges, as defined by Internal Revenue Code (IRC) Section 1031, are still the preferred arrangement for more active and involved investors selling and reinvesting in real estate on a tax-deferred basis.

It is important to remember that prior to the Tax Cuts and Jobs Acts (TCJA), Section 1031 applied to like-kind exchanges of any property type (both personal and real), held for productive use in a trade or business, or for investment if said property was exchanged solely for property of like-kind to be held for productive use in a trade or business or for investment purposes. That is no longer the case, as post-TCJA, like-kind exchanges now apply only to exchanges of real property!

It might be worth taking a moment to review the main requirements necessary to complete an IRS-compliant 1031 deferred exchange:

An exchange must occur between relinquished and replacement property;

-

The exchange must be comprised of real property that is used in a trade or business, or for investment purposes;

-

The replacement property must be of like-kind to the relinquished property in the exchange;

-

Stringent time periods must be adhered to: 45 days to identify replacement property and the entire exchange completed within 180 days.

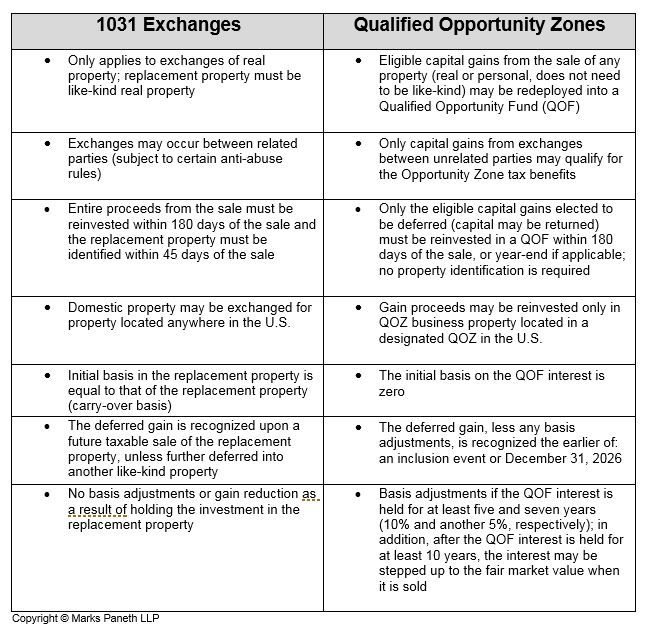

In this light, let’s look at a side-by-side comparison of the new QOZ program and the (now more restricted) 1031 exchange, both of which are income tax deferral strategies. And to remind everyone about QOZs: The Opportunity Zone program is a new investment alternative created under a provision of the TCJA. It was developed to encourage investors to direct capital gain proceeds into government-classified economically distressed communities, thereby creating jobs and economic development in these areas. The program has been attracting significant interest - not only in operating businesses in Opportunity Zones, but also in investing in real property in these markets. When certain funds are invested in these communities, known as QOZs, investors can benefit from various tax incentives.

That said, let’s look at some of the ways the two programs differ:

Entering into a 1031 like-kind exchange allows investors to preserve the gross equity from the real estate investment. These may be more appropriate for an active, experienced real estate investor who has the resources and long-term timeline required for continuing oversight and management. On the other hand, investors with capital gains coming from an appreciated asset (aside from real estate such as stocks, bonds or other business assets) may find that a QOF is the more favorable way to go.

As with any tax transaction, especially one which pertains to the deferral of income taxes, you should consult with your Marks Paneth advisor to determine what is the best alternative based on your own specific circumstances.