Valuation Discounts Applicable to Real Estate Holding Companies (PART 2)

By Angela Sadang | August 19, 2019After discussing the application of a minority discount or discount for lack of control (DLOC) in the last issue of Real Estate Perspectives, I will now turn to discussing the next incremental adjustment in the valuation of partial, non-controlling interests in entities holding real estate as their primary and most valuable asset. In this article, we will address the use of the discount for lack of marketability (DLOM) applicable to interests in real estate holding companies.

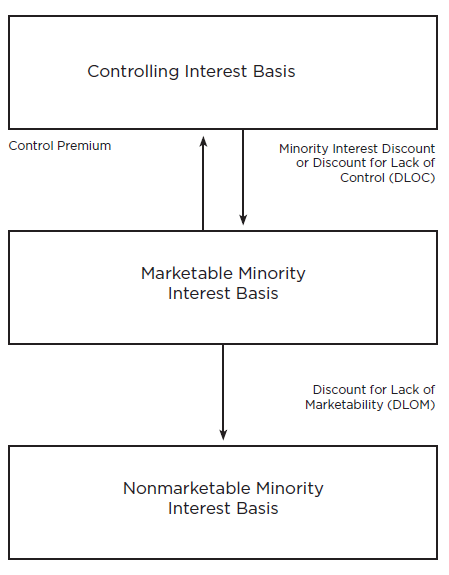

The diagram below graphically illustrates the basic levels of value as we apply discounts: the starting point is the control level which, as discussed in my last article, emanates from the 100% net asset value of the real estate holding entity. The marketable minority (or “as-if freely traded”) level results from the application of a minority discount (which was the subject of my first article) and conversely, the application of a control premium from the freely traded value brings you back to the control level. The lowest level is called the nonmarketable minority level which results from the application of a DLOM and represents the conceptual value of nonmarketable (i.e., illiquid) minority interests of privately held real estate holding entities that lack active markets for their shares.

A discount for lack of marketability is used to compensate for the difficulty of selling shares of stock that are not traded on a public stock exchange. For instance: while shares of IBM, Google or Apple trade on public stock exchanges and can be converted to cash within three days, investments in real estate holding entities or any privately held business can take months or even years to sell. The degree of impaired marketability is even more significant for an owner of a non-controlling (i.e., minority) interest in a privately held entity that owns real estate, due to the inherent riskiness of real estate as an asset class versus other alternative assets and the inability to sell

a real estate asset quickly.

As mentioned in my previous article, business appraisers review the independently performed appraisal of real estate properties as a first step in performing the valuation of certain ownership interests in real estate holding entities. Such independent appraisals of underlying real estate properties typically assume a marketing period of at least six months to a year, and do not include any opinions on the DLOM of the real estate properties, except in unusual circumstances. Therefore, the determination of the DLOM applicable to interests in real estate holding entities falls on the business valuation specialist/appraiser.

In determining the DLOM, we review and dissect data obtained from various sources, the most widely used of which are restricted stock studies and pre-IPO studies. There are a multitude of empirical studies and methods to determining the DLOM. Some business appraisers turn to regression analyses and other mathematical formulas to better support their DLOM calculations. Aside from benchmark restricted stock studies and pre-IPO studies, option pricing models such as the Black-Scholes, Finnerty and Chaffee models quantify the cost of an option based on the price of comparable publicly traded stock options and inputs related to the subject interest.

Other quantitative models include the Quantitative Marketability Discount Model (QMDM) and Long-Term Anticipation Equity Securities (LEAPS). The quantitative models have been criticized due to the number of subjective inputs required to conclude on a DLOM. In Mandelbaum v. Commissioner, Judge David Laro proposed a list of nine factors for valuators to consider when quantifying a DLOM:

1. Financial statement analysis;

2. Company dividend policy;

3. Nature of the company (history, position in industry, economic outlook);

4. Company management;

5. Amount of control in subject business interest;

6. Restrictions of transferability of stock;

7. Holding period for stock;

8. Company redemption policy; and

9. Costs associated with making a public offering.

There are many other methods used to develop DLOM, such as flotation cost or bid-ask spread methodologies, however, there is no consensus on what methods are definitive or acceptable. And none is likely to gain universal acceptance in the foreseeable future.

We valuators do not simply apply a methodology or refer to the mean or median from a pre-IPO or restricted stock study. I have heard a few clients ask, “Why can’t we just apply a DLOM of say, 25% or a total discount of 40% and call it a day?” The long answer is that in order for DLOM to withstand IRS scrutiny, we synthesize the available empirical data with our intimate understanding of the specific facts, circumstances and marketability features of the real estate holding entity - including the transfer restrictions specific to the minority interest in the entity, the dividend policy, potential buyers of the interest, remaining term of the entity, riskiness and type of real estate assets owned by the entity, and size and value of the interest.

Analyzing the specific characteristics of the company may include applying a discounted cash flow analysis typically over an investment time horizon and determining a market value for the interest that would generate an appropriate internal rate of return (IRR). We may make assumptions on annual yield and annual appreciation on the property for a specific period, the rate of distributions, the expected dissolution date of the entity. Based on these assumptions, we determine a reasonable DLOM based on investors’ expected rates of return when participating

in a publicly registered real estate limited partnership. Anticipated returns on investments in various types of portfolio funds are reported in Partnership Profiles, Inc.’s annual Rate of Return Study which, as mentioned in my previous article, we also defer to when determining DLOC. Thus, in the end, the determination of DLOM is intertwined with the determination of DLOC and ultimately, in the determination of the fair market value of the interest.

The valuation process for real estate holding entities involves complexity and multiple considerations. Hiring a qualified and experienced business appraiser to prepare a comprehensive and defensible valuation report provides more than tax savings - it can also lower the risks of an audit and potential costly litigation.

About Angela Sadang

Angela Sadang is a Principal in the Advisory Services group at Marks Paneth LLP. Ms. Sadang specializes in business valuations and the valuation of intangible assets and has over 20 years' experience providing corporate financial consulting services and performing valuations. She serves both publicly traded and closely held companies in a wide range of industries that also involves various asset classes. Ms. Sadang is a Chartered Financial Analyst (CFA) as designated by the CFA Institute and is... READ MORE +