Is it a Grant or a Contribution? FASB Has Now Made It Clearer

By John D'Amico | January 3, 2019There has been a long-standing diversity in practice on how nonprofits accounted for grants, especially government grants. FASB has now effectively ended this diversity and clarified its guidance with the issuance of Accounting Standards Update (ASU) 2018-08, “Clarifying the Scope and Accounting Guidance for Contributions Received and Made,” and it is effective for periods ending December 31, 2019 and thereafter, except for organizations that are considered public entities for which it is effective for periods ending June 30, 2019 and thereafter.

This ASU will help organizations determine if revenue transactions should be accounted for as contributions within the scope of Accounting Standards Codification (ASC) Topic 958, Not-for-Profit Entities, or as an exchange transaction subject to ASC Topic 606 amended by ASU 2014-09— affectionately known as the “Rev Rec standards”

A grant can either be an exchange transaction or a contribution depending on the grant agreement. Actually, the words “grants” and “contributions” have historically been used synonymously, causing misconceptions. The distinction between the two depends on the following: in an exchange transaction, both parties receive something of approximately equal value (a reciprocal transaction), whereas the recipient of a contribution does not have to do anything to earn it (a nonreciprocal transaction).

Why is this distinction important to determine? Because it determines when and how the revenue will be recorded.

Exchange Transactions

An exchange transaction is when the grantor directly receives something in exchange for the funds provided of approximate equal value, such as goods or services that the grantor directly receives. FASB guidance has now made it clear that grants that benefit the general public are not exchange transactions as the grantor is not directly receiving something of approximate equal value.

The nonprofit would recognize revenue when they fulfil the grant requirements by providing the goods or services directly to the grantor. Exchange transactions are accounted for using ASU 2014-09 Revenue from Contracts with Customers ASC Topic 606, and are effective for periods ending December 31, 2019, except for organizations considered public entities for which they are effective for periods ending December 31, 2018. Government and Foundation grants that benefit the general public and not the grantor directly are excluded from this accounting standard, as those are not considered to be exchange transactions.

Contributions

A contribution is when the grantor/contributor makes an unconditional transfer of cash or other assets, or a reduction, settlement or cancellation of its liabilities to an entity in a voluntary nonreciprocal transfer, and does not directly receive something of approximate equal value for the funds provided. The nonprofit would recognize revenue when the contribution is received or when a pledge is made, as the nonprofit does not have to do anything to “earn” it. Contributions are accounted for under ASC 958-605 Not-For-Profit Entities – Revenue Recognition amended by ASU 2018-08.

The ASU clearly states that government and foundation grants that benefit the general public or society, such as a child care grant or a grant to provide homeless services, are contributions and nonreciprocal transactions because the government or foundation is not directly receiving something of approximate equal value. The issue is: who is directly receiving the benefit? If it is not the grantor directly, then the transaction is a contribution. Basically, what FASB is stating is that the government is not synonymous with the general public. Also, if the government or foundation grantor receives value indirectly by providing a societal benefit, it would still be considered as a contribution and not an exchange transaction. Therefore, the majority of government and foundation grants/contracts will now have to be considered as contributions (nonreciprocal) and the accounting will have to follow the standards as stated in ASU 2018-08.

But before organizations start recording their government and foundation grants as contributions as soon as they receive the funds or are aware of the grant, please continue reading.

How Will This All Work

To make this work for government/foundation grants, FASB had to change the definition of conditional contribution by revising it to be a contribution where there is a right of return/release from obligation and a measurable barrier to overcome. An organization must consider the following:

Consideration #1

Reciprocal (exchange) transaction versus nonreciprocal (contribution)

If both parties of the transaction receive commensurate value, then it is an exchange transaction and the organization should follow guidance in ASC Topic 606 as amended by ASU 2014-09. If not, it is nonreciprocal (contribution) — see consideration #2. It is important to note that exchange transactions cannot result in revenue being recorded as “with donor restrictions.”

Consideration #2

Conditional versus unconditional

Organizations must determine whether a contribution is conditional or not. It is conditional if the agreement includes a barrier(s) that must be overcome and either a right of return of assets transferred or a right of release of a promisor’s obligation to transfer assets. If an agreement has both a barrier and a right of return or a right of release, the recipient should not recognize revenue until the barrier(s) are overcome. Funds received in advance of the barrier(s) being overcome should be recorded as deferred revenue.

Indicators are used to determine if the agreement contains a barrier:

- Measurable performance-related barrier or other measurable barrier, such as providing the services required in the agreement

- The extent to which a stipulation limits discretion by the recipient on the conduct of the activity, such as a requirement to follow specific guidelines about or qualifying allowable expenses, or a specific protocol that must be adhered to

- A limited discretion stipulation and whether a stipulation is related to the purpose of the agreement – this indicator excludes administrative tasks and trivial stipulations.

If there are no donor-imposed conditions placed on this gift, recognize revenue when received or known and determine if there is a donor-imposed restriction or not. If there is a donor-imposed restriction on how or when the contribution should be used, it should be recorded as a contribution “with donor restrictions.” If there is no restriction on the contribution, it should be recorded as a contribution “without donor restrictions.”

Required Footnote Disclosures

Classifying government grants as conditional contributions will result in an additional footnote disclosure for many organizations that receive government grants.

For unconditional promises to give, an organization needs to disclose the following:

- The amount of promises to give that are receivable in less than one year, in one to five years, and in more than five years

- The amount of the allowance for uncollectible promises to give

- The discount rate to present value the receivables due more than one year.

For conditional promises to give, an organization needs to disclose the following:

- The total of the amounts promised

- A description and amount of each group of promises having similar characteristics, such as amounts of promises conditioned on establishing new programs, completing, a new building, and raising matching gifts by a specified date.

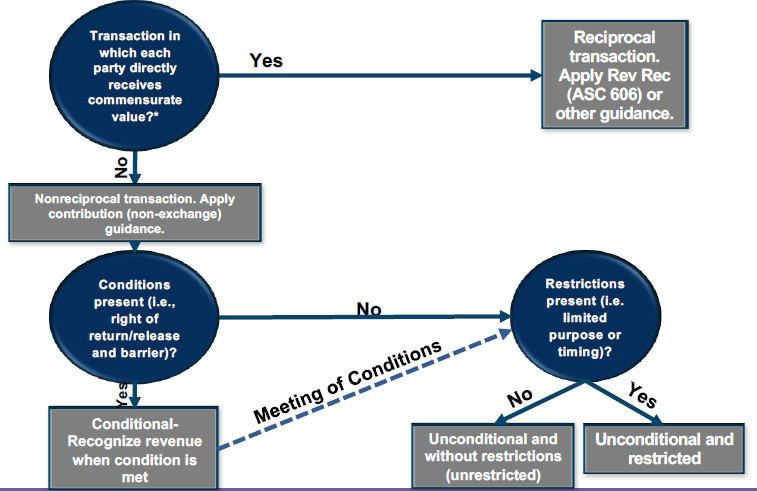

If you still have questions, the following chart can be useful to help you determine which accounting standards to follow:

Source: Financial Accounting Standards Board (FASB)

This article originally appeared in the Jan/Feb 2019 issue of Taxation of Exempts Journal by Thompson Reuters.

About John D'Amico

John D'Amico, CPA, is a Partner within the Professional Standards Group at Marks Paneth LLP, which is responsible for monitoring quality control in the firm as mandated by professional standards. He specializes in pre-issuance reviews and inspections of nonprofit organizations, governments and Single Audits. Mr. D’Amico also provides consultation on accounting and attestation matters and tests and monitors the firm's quality review policies and procedures. He teaches continuing education classes for the firm and on... READ MORE +